Fica | Yugoslavia S Most Iconic Car The Zastava 750 The Fica Fabian S Website

The Federal Insurance Contributions Act FICA is a federal law that requires employers to withhold three different types of employment taxes from their employees paychecks. According to FICA banks must ensure that the customer information that the bank keeps is correct and up to date as.

What Is Fica Tax And Why Do I Have To Pay It

Frequently asked questions about the FICA tax Is FICA tax the same as Social Security.

Fica. Different rates apply for these taxes. Employers remit withholding tax on an employees behalf. Taxes under the Federal Insurance Contributions Act FICA are composed of the old-age survivors and disability insurance taxes also known as social security taxes and the hospital insurance tax also known as Medicare taxes.

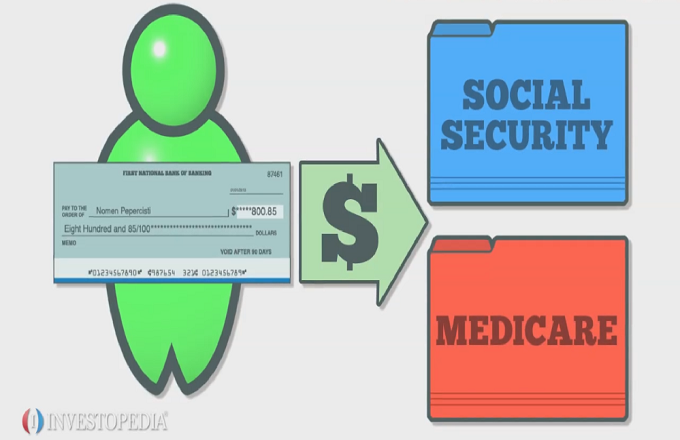

South Africas Financial Intelligence Centre Act FICA was introduced in 2001 establishing the countrys Financial Intelligence Centre FIC and introducing a basic framework to bring the countrys AMLCFT regulations into alignment with those of the wider international communityThe Financial Intelligence Centre itself was established in 2003 two years after. It stands for the. The Federal Insurance Contributions Act FICA ˈ f aɪ k ə is a United States federal payroll or employment contribution directed towards both employees and employers to fund Social Security and Medicare federal programs that provide benefits for retirees people with disabilities and children of deceased workers.

The Federal Insurance Contributions Act FICA is a US. FICA taxes are payroll taxes originally part of the Social Security program but made part of the Internal Revenue Code in 1939. No but they are closely connected.

For 2021 an employee will pay. What are FICA Taxes. Your nine-digit number helps Social Security accurately record your covered wages or self-employment.

145 Medicare tax on the first 200000 of wages 250000 for joint returns. If you earn a wage or a salary youre likely subject to FICA taxes. Here is a breakdown of these taxes.

It consists of two types of taxes. FICA synonyms FICA pronunciation FICA translation English dictionary definition of FICA. Social Security and Medicare.

62 Social Security tax withheld from the first 137700 an employee makes in 2020. The breakdown for the two taxes is 62 for Social Security on wages up to 137700 and 145 for Medicare. The FICA tax is designed to provide support for retirees who qualify for benefits.

FICA mandates that three separate taxes be withheld from an employees gross earnings. These taxes include 124 percent of compensation in Social Security taxes 29 percent of salary in Medicare taxes totaling 153 percent of each paycheck. As you work and earn and then pay your FICA taxes you earn credits for Social Security benefits says Michael.

Social Security and Medicare Withholding Rates. And is deducted from each paycheck. This Act has put South Africa in line with similar legislation in other countries.

Financial Intelligence Centre Act 38 of 2001. As an employer you are required to withhold 62 of each employees taxable gross wages to cover this tax up to a maximum wage base limit. The employer and employee each pay 765.

Once an employees salary reaches that limit they are no longer required to pay this tax. 145 Medicare tax withheld on all of an employees wages. The first part of FICA is the Social Security Tax.

FICA is a mandatory payroll tax equally split between employees and employers. As you work and earn and then pay your FICA taxes you earn credits for Social Security benefits says Michael. 09 Medicare surtax withheld on single filer employee wages over 200000 per calendar year over 250000 for.

FICA does not only help curb these illegal activities but also helps to keep the money of South African citizens safe. What is FICA tax. Since Social Security is a part of the FICA tax the money from your FICA contribution goes toward Social Security programs including retirement disability survivors and childrens benefitsQualified retirees and people who are disabled can use these benefits as their partial.

Law that mandates a payroll tax on the paychecks of employees as well as contributions from. FICA came into effect on 1 July 2001 to fight crimes such as money laundering tax evasion and other unlawful financial activities. Federal Insurance Contributions Act FICA is an act that mandates withholding of taxes from employees paycheck and matching that with an equal contribution from the employer to fund the Social Security and Medicare Program.

Paycheck City is a free online withholding calculator. This tool allows people to not only calculate federal and all state withholding but also FICA tax. FICA stands for Federal Insurance Contributions Act.

Federal Insurance Contributions Act American Heritage Dictionary of. FICA is a US. FICA tax deductions provide benefits to older Americans retired people widows and widowers children who have lost.

FICA stands for Federal Insurance Contributions Act Not to be confused with the federal income tax FICA taxes fund the Social Security and Medicare programs and add up to 765 of your pay in 2020. The total FICA tax is 153 based on an employees gross pay. Unlike federal income tax FICA tax is a percentage of each employees taxable wages.

For the 2021 tax year the wage base limit is 142800. See how FICA tax works in 2021. FICA taxes also provide a chunk of Medicares budget.

If an employer has questions regarding the SUTA it would be wise to inquire with the proper agency. Part of the FICA percentage goes toward Social Security and the other part goes toward Medicare. This is a list of all state unemployment agencies.

This is the tax that pays for Social Security Disability Social Security retirement and Medicare benefits. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. South Africa introduced FICA in 2001 to help fight financial crimes such as money laundering the financing of terrorist activities and to protect banking customers from such crimes.

This contribution helps your parents and grandparents have a secure retirement while securing today and tomorrow for you and your future family. For 2021 the FICA tax rate for employers is 76562 for OASDI and 145 for HI the same as in 2020. Federal Insurance Contributions Act.

The FICA tax is designed to provide support for retirees who qualify for benefits. FICA the Federal Insurance Contributions Act refers to the taxes that largely fund Social Security retirement disability survivors spousal and childrens benefits. FICA taxes help provide benefits for retirees disabled people and children.

Therefore to be eligible for Social Security Disability benefits you are required to. The Breakdown of FICA Tax. As you work and pay FICA taxes.

Within that 765 the OASDI Old Age Survivors and Disability program AKA Social Security portion is 62up to the annual maximum wages subject to Social Security. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus.

Zastava Fica 750 Startsida Facebook

Zastava 750 Fica Red In Jagodina Serbia Zastava 750 F Flickr

Political Slogan On Zastava Fica Licence Built Fiat 600 Car Koper Capodistria Primorska Slovenia Istria Balkans Adriatic Sea Eastern Europe Stock Photo Alamy

Ekapija Monument To Fica To Be Raised In Kragujevac

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)

Federal Insurance Contributions Act Fica Definition

Zastava Fica 750 Startsida Facebook

Yugoslavia S Most Iconic Car The Zastava 750 The Fica Fabian S Website

Zastava 750 Fica Sarajevo Times

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About Fica Social Security And Medicare Taxes

Fica Tax Exemption For Nonresident Aliens Explained

Federal Insurance Contributions Act Fica Definition

Zastava Fica Redaktionell Fotografering For Bildbyraer Bild Av Detta 76302919

/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act Fica Definition

1972 Zastava 750 Fica Illustration By Nikola Lazarevic On Dribbble

Fica Hd Stock Images Shutterstock

Fica Em Casa Skrivet I En Lightbox Text Det Betyder Stanna Hemma Pa Portugisiska Coronavirus Koncept Karantan Och Isolering Nytt Coronavirus Covid19 Foton Och Fler Bilder Pa 2019 Istock

Fica Em Casa Skrivet I En Lightbox Text Det Betyder Stanna Hemma Pa Portugisiska Coronavirus Koncept Karantan Och Isolering Nytt Coronavirus Covid19 Foton Och Fler Bilder Pa 2019 Istock